The latest Home Office enforcement data highlights a clear trend: employer civil penalties for illegal working has been rising steeply over past years.

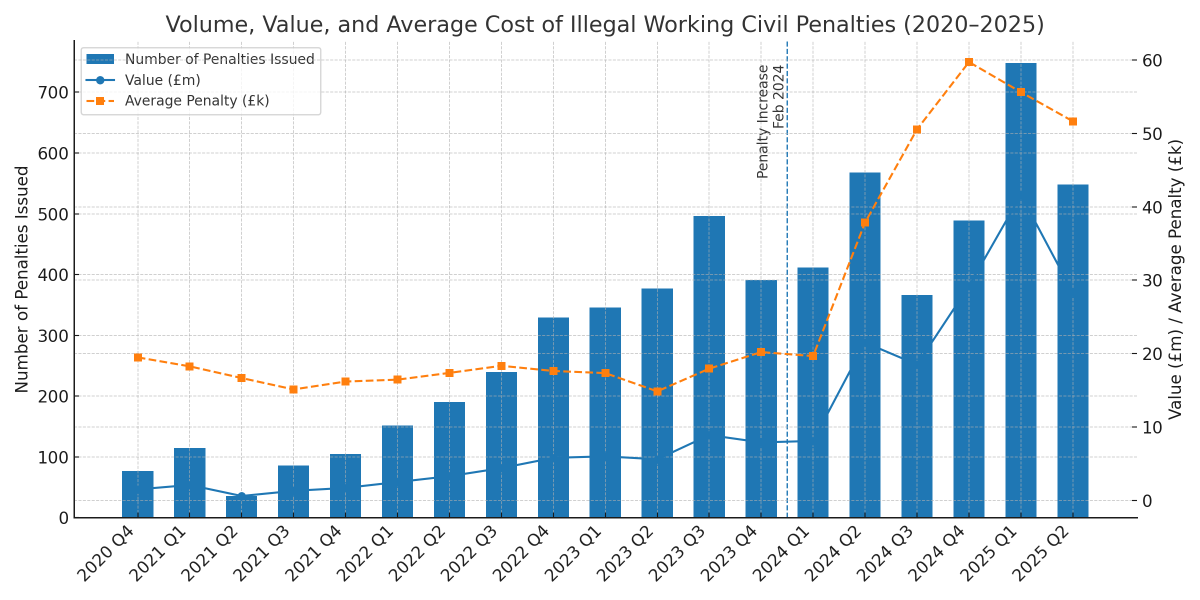

From late 2020 through 2023, the number of penalties issued rose steadily, moving from just 77 cases in Q4 2020 to an average of over 400 cases per quarter during 2023. The value of fines increased in parallel, from £1.5 million in Q4 2020 to an average of £7 million per quarter in 2023.

Figure 1: Volume, value, and average cost of illegal working civil penalties, 2020–2025

But the picture changes dramatically from Q2 2024. That quarter saw 568 penalties issued, with the value of fines surging to £21.5 million – nearly triple the previous quarter. By Q1 2025, penalties reached a record 748 cases and £41.6 million in fines, before easing slightly in Q2 2025 to 548 cases and £28.3 million. The overall trend, however, remains upward.

Two recent policy shifts may help explain the data.

End To Sponsor Licence Renewals

Firstly, from 6 April 2024, the manual sponsor licence renewal process was replaced by automatic extensions in 10-year increments. This is likely to have freed up Home Office resources for audit and compliance activity, resulting in more employers being found in breach.

Significant Increase to Illegal Worker Fines

Secondly, and perhaps more significantly, the civil penalty cap for illegal working tripled in February 2024 – from £15,000 to £45,000 per illegal worker for a first breach, and from £20,000 to £60,000 for any subsequent breach. Unsurprisingly, this has driven the average cost per penalty sharply upwards. In 2023, the average penalty stood at around £18,000 per case. Since Q2 2024, it has been around £51,000 per case, peaking above £55,000 in early 2025.

This increase, introduced alongside a revised Code of Practice on Preventing Illegal Working, formed part of a wider set of measures deployed by successive governments to discourage illegal migration and employment.

The Civil Penalty Framework In The UK

It is important here to understand the civil penalty framework in the UK: employers are under a strict legal duty to prevent illegal working. They should therefore carry out prescribed right‑to‑work checks on all staff, including British and Irish nationals, EU citizens, and non‑EU nationals.

A valid right‑to‑work check provides employers with a ‘statutory excuse’, shielding them from penalties if an employee is later found to be working illegally. The guidance on the required right‑to‑work steps – an essential part of the UK hiring process – is set out in the Home Office’s Employer’s Guide.

Sponsor Licence Holders

Carrying out compliant right-to-work checks is a mandatory obligation for all sponsor licence holders. Failure to complete a valid check constitutes a breach of that duty. Sponsors who neglect this responsibility risk enforcement action against their licence, even where no illegal working has actually taken place.

This effectively creates a dual liability for registered sponsors: while they may not be liable for a civil penalty where no illegal working has taken place, they remain at risk of having their sponsor licence suspended or even revoked if proper checks are not carried out.

Takeaway for Employers

While Q2 2025 shows a modest drop-off in fines compared to the peak reached in Q1 2025, the clear message is that enforcement is now both more aggressive and more costly for non-compliance. As the Minister for Immigration put it when announcing the tougher penalties in summer 2023:

“There is no excuse for not conducting the appropriate checks and those in breach will now face significantly tougher penalties.”

Employers should therefore ensure right-to-work checks are robust, well-documented, and consistently applied across their workforce. The financial and reputational risks of non-compliance have never been higher. Moreover, the new procedural requirements accompanying the digitalisation of many types of immigration status make it more important than ever for employers to remain up to date with evolving government processes and compliance obligations.

At Brecher, our dedicated and experienced immigration team can help you strengthen right-to-work practices and establish compliance procedures that protect both the operations and reputation of your business. Get in touch to find out how we can support you.

This update is for general purpose and guidance only and does not constitute legal advice. Specific legal advice should be taken before acting on any of the topics covered. No part of this update may be used, reproduced, stored or transmitted in any form, or by any means without the prior permission of Brecher LLP.